Accidents at work can have a severe impact upon the victim and any witnesses that saw what happened during the incident. You didn’t deserve to get hurt, but the accident still happened. That means you have to bear the brunt of what happened to you. It may take you months to recover from your injuries. However, during this time you may suffer from more than just your physical damages. In order to help with the recovery process, you may be considering claiming for compensation. After all, you may need to pay for medical assistance and recovery treatments that could get you back on track. Unfortunately, you may be feeling unsure about whether or not your injuries are severe enough for you to make a valid compensation claim. That’s why it’s essential that you get the right legal assistance to get you started with your compensation claim.

Gowing Law Solicitors is here to help with any types of accidents at work. Our law firm can give you the advice you need to get started. To talk to one of our specialists, call 0800 041 8350 or use the link below to visit our work accidents page.

How do I know if I have a valid accidents at work claim?

Accidents at work claims can be extremely complicated, depending on the severity of the incident and the extent of your evidence. The best way to determine whether or not you could be owed a compensation pay-out is in relation to negligence. Your employer owes you a ”duty of care”. Quite literally, this means that your employer has a responsibility to keep you safe when you go into the work place. That means that they should give you:

- Proper health & safety training

- Advice on how to handle customers in the work place

- A tour around the workplace to show the escape exits

- Appropriate breaks and lunch breaks

- A safe and tidy environment to work in

If your employer did not provide you with reasonable training and help to get you used to your position in the company, and this ended up leading to an accident, they could be responsible for your injuries. That means you will have a valid accidents at work claim and will be able to claim compensation.

What could have caused my accident at work?

In order to claim compensation, you need to prove that you are a victim of negligence in the workplace. That means something happened that you were not responsible for. Instead, it was due to the fault of your manager or a higher authority in your workplace.

There are many ways that you could have got hurt in the workplace. It is your manager’s responsibility to ensure that you are safe throughout your workday so you feel comfortable in your job. Your employer has the responsibility to:

- Understand the health and safety risks of the workplace

- Making sure workers are supported if they are hurt

- Ensuring that there is a report system in place to announce any accidents

With that said, it is unfortunate, but work accidents do still happen despite there being safety regulations put in place to protect employees. Here are some of the most common ways that you could get hurt at work:

As you can see, there are many different ways that you could get hurt in the workplace. If you are working somewhere that is extremely messy (i.e. is a very enclosed space, has exposed wiring on the floor or is untidy in general), it is very likely that you (or perhaps a customer) will get hurt. Keep an eye on any uneven surfaces in your workplace as these can be tripping hazards. It’s estimated that around 38.8 million work days are lost due to these types of accidents. That’s why it’s important to report any hazards to your work employer/manager if you spot any. If the problem is not fixed you can then use this as evidence that you are the victim of negligence.

What counts as negligence?

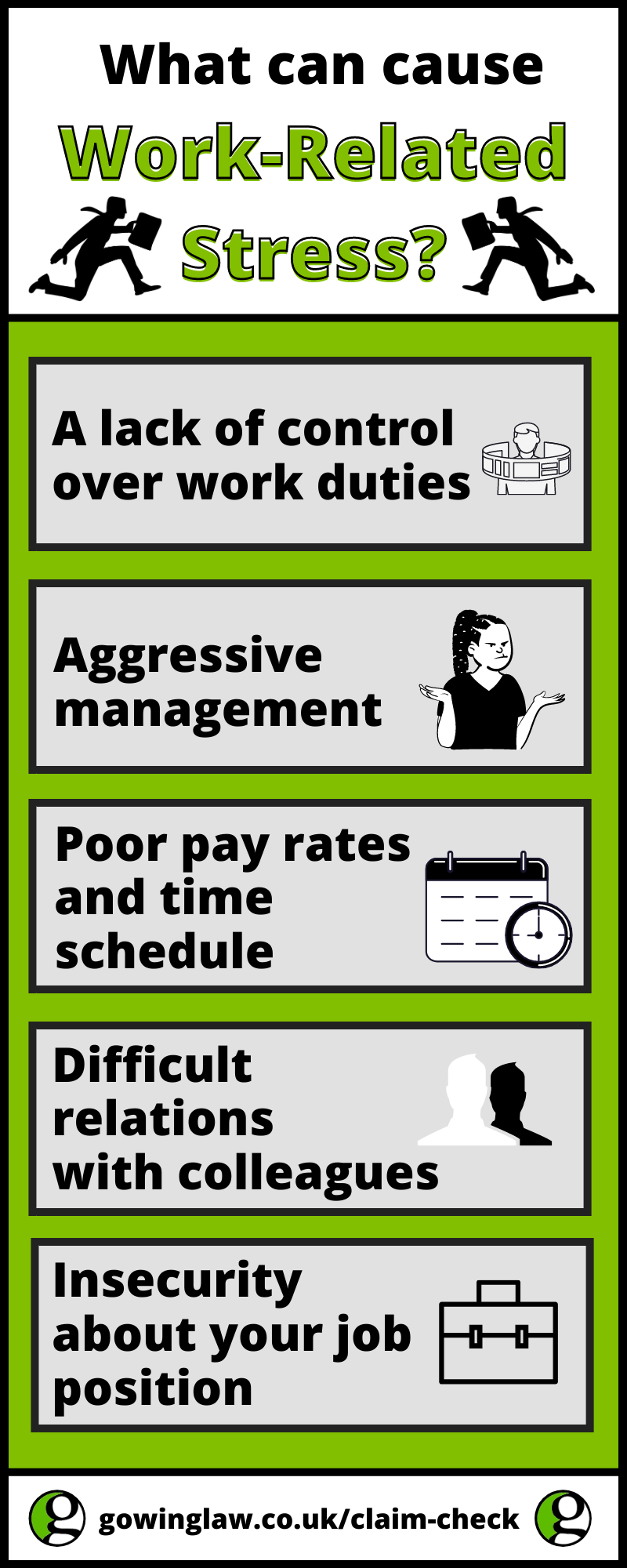

If you are going to have a successful work accident claim, you need to understand what could actually count as negligence from your employer. Your employer has a duty to keep you safe in the workplace. If you get hurt then they have a responsibility to get you medical treatment and to help you recover. Sadly, if your employer does not put your health and safety first then you could be put in danger. Here are some examples of how you could be a victim of negligence:

- Refusing to supply PPE to workers

- Not completing a health & safety risk assessment for the workplace

- Refusing to keep machinery and equipment updated

- Not providing efficient training for staff

- Refusing to give staff proper breaks and lunches

- Not listening to staff concerns, complaints or worries

- Providing a messy work environment

It’s important for employers to listen to their staff. After all, your workers are the blood of your business. Therefore, if they notice something is wrong then it is your duty to have it sorted. If you do not have it fixed up and someone gets hurt, it is very likely that you could have a compensation claim to deal with.

Office Accidents: Repetitive Strain Injuries

There are many different types of accidents at work that could occur and cause you to get hurt. Naturally, the type of injury that you suffer from will depend on the type of industry that you are in. For instance, if you work in a construction site, it’s more likely that you are going to suffer from injuries that could occur from faulty equipment. However, if you work in an office, it’s very likely that you will experience injuries due to a cramped environment, messy merchandise or jobs that they do not have the skills to complete.

One thing that could happen is in relation to repetitive tasks. If you do the same action day in and day out, such as typing or using a computer, it’s likely that you could claim for a repetitive strain injury. A repetitive strain can happen due to swollen and inflamed muscles. It can also happen if a nerve is pinched from repetitive movements. If it is left untreated, there is a chance that it could change into arthritis or could cause serious nerve damage.

You may feel unsure about whether or not this could be counted as a work accident injury, which is why you may feel unsure about whether or not you could claim compensation. But we are here to tell you that it is counted! You just need a doctor’s report to prove that you have suffered due to your work actions. That way adjustments can be made to your schedule and you can take time out to recover.

What type of injuries classify for an accident at work claim?

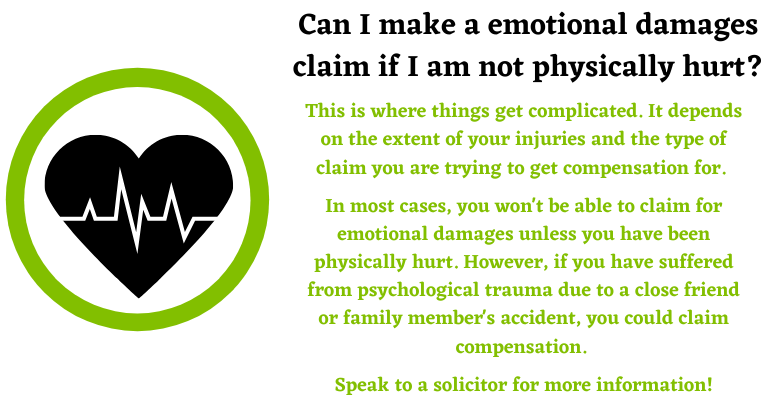

Quite honestly, we would say that any type of injury that was caused by the negligence of your employer will allow you to be eligible for a compensation claim. However, keep in mind that the extent of your injuries will determine how much compensation you receive. Therefore, you need to decide on whether or not you think it’s worth it. For instance, if you have just received a few bruises from a fall, there may not be much point in making a claim. However, if you have experienced quite serious injuries then you could make a claim for work accident compensation.

Some examples of work accident injuries include:

- Broken bones

- Sprains and injured muscles

- Internal bleeding

- Damage to internal organs

- Loss of limbs

- Brain damage

- Loss of hearing/vision

It’s important that you speak to your solicitor in order to figure out the extent of your damages. That way you can figure out how much you could be potentially owed from the other party. Speaking with a lawyer will also help you understand whether or not it is worth pursuing the claim. They can help you collect evidence and get you ready for a settlement agreement with the other party and their insurer.

What should I do if I have had an accident at work?

Now that you understand what type of accidents at work will qualify you for a compensation pay-out, it’s important to understand what you can do to make sure that you get the largest pay-out possible. There are certain things that you can do that can help your solicitor with your case. If you get hurt, you should alert your manager as quickly as possible. That way they can have it notified in the work accident book and also get you the medical help that you need. You should contact the emergency services as quickly as possible if you have been hurt. Even if you have you only suffered from minor injuries, it’s better to be safe and sorry. A doctor can assess your wounds and injuries and give you a proper medical report.

If you can collect evidence from the scene of the accident, that will also help your case. Your evidence can come before, during and after the accident occurred. For instance, if you alerted your manager before the accident happened, and nothing was changed to prevent the accident from happening, you can use that to show you suffered from negligence. Have a look at the evidence examples below to get a good idea of what you could use:

- Photographs of the accident and your injuries

- Video footage, CCTV footage and Dash-cam footage

- Witness statements

- Medical records

- Police records

- Communication with insurers and employees (emails)

- Diary entries

- Receipts (i.e. travel costs)

From there, you should consider organizing this evidence to bring it to your solicitor to start on your case. They can give you the best advice possible and help you start the preparations for a settlement agreement meeting.

How could the pandemic affect my work accidents claim?

Although there is talk about the lockdown being eased down, it’s important that you understand that you can still make a work accident claim. The main differences you may experience is in relation to the amount of time it takes to get your compensation. The courts are currently experiencing delays due to the backlog of court cases and the current lockdown. That means it may take a little longer to receive your compensation. If you do end up going to court, you may have to undertake a case remotely. That means you will have to join a session through your computer through a video link. Make sure you have strong Wi-Fi and are sitting in a quiet room so you can hear the judge. Your solicitor can make you are supported throughout the session.

Gowing Law Solicitors can help you with your accidents at work claim

If you want to learn more about how Gowing Law Solicitors can help you with your claim, why not get in contact with our law firm to get started? Our solicitors can give you advice on your accidents at work claim for free. You can also speak to our lawyers for no-obligation consultations to get started. If you are happy to move forward with your case with our specialist team, we can offer our solicitors on a “no win-no fee” basis. That means you will never need to pay any hidden fees. Instead, you will only need to pay our solicitors if they win your case. That’s why you should get in contact as soon as possible to begin your claim.

Contact Gowing Law’s work accident team today to start your claim. You can call 08000418350, email info@gowinglaw.co.uk or you can use our claims checker. One of our team members will then be in contact to answer your questions.

Read more about accidents at work claims

If you want to learn more about work accidents claims, why not visit our blog for the latest updates? We write about different claims every week. This includes tax claims, insurance claims, PI claims and immigration Visas. If you have a suggestion about the type of content you would like to see us write about, send in your suggestions to info@gowinglaw.co.uk. You should also check out our social media pages to see our latest videos and giveaways. You could win a prize. Check out our Twitter and Facebook through the links below.

We look forward to helping you soon with your claim!

Recent Comments