If you are looking to make a PPI Tax refund, it’s important you understand the type of claim you are trying to make. You also need to consider how much you could get from your claim. We understand that it can be frustrating. You don’t want to ask for compensation for a second time, just after you have just successfully a pay-out from your PPI. That’s why it’s useful to have the help of a tax solicitor to get you on the right track.

With any sort of PPI Tax reclaim, the first thing on your mind is going to be how much of a compensation pay-out you are going to receive. That’s why you may want to figure out a rough estimate. This will really help you to calculate how much you could be owed. You can also get a more succinct figure from a specialist at Gowing Law Solicitors. Either way, this blog is a great place to start if you want to understand how much you could be owed from HMRC.

To find out more about PPI Tax claims, why not call us today at 0800 041 8350 or visit our PPI Tax page below:

Why did I need to pay PPI Tax in the first place?

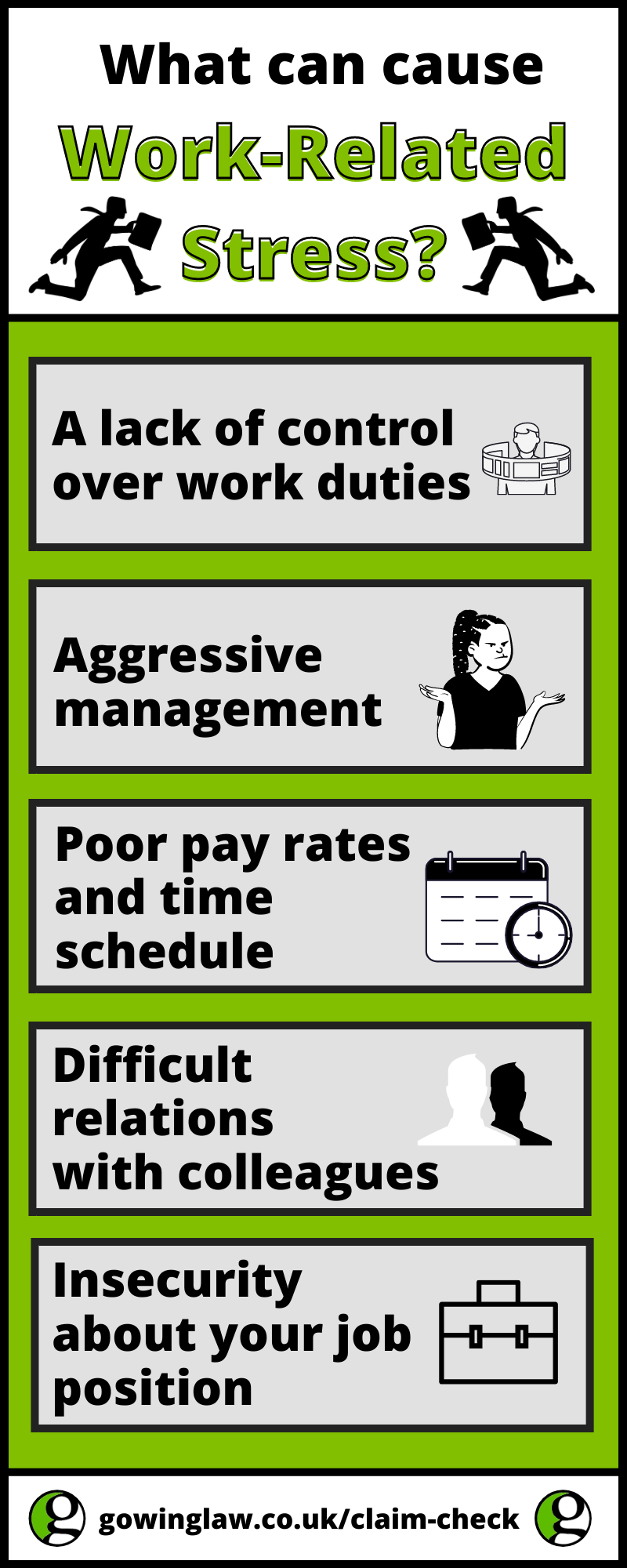

Before we jump into the maths behind claiming a PPI tax refund, it’s important that you know the basics of PPI. PPI stands for “Payment Protection Insurance.” Originally, it was used as a safety net just in case you could not pay back a financial agreement. This included credit cards, loans and catalogue payments. Unfortunately, in most cases, these policies were mis-sold. Not only did they not provide enough money to pay off the financial agreements, but in most cases they actually did not suit the policy holder. Take a look at the infographic below to see how your PPI was mis-sold in the first place:

As you can see, there are many ways that you could have been mis-sold PPI. That’s why HMRC has been issuing refunds and compensation pay-outs. This way claimants can be returned to the amount they were meant to be at before they lost money on PPI. Unfortunately, in quite a few cases, even though they received a pay-out, they did not receive the full amount. This is due to the fact that around 20% of the pay-out could have been taken away as tax.

Now that you understand that the basics of PPI, you may be wondering why this tax was taken away from you in the first place. Let’s delve into that a little further.

Why did I lose some of my pay-out?

If you want to receive a PPI tax refund, you need to understand why you lost it in the first place. Having your PPI tax taken away most likely came from no fault of your own. In some cases, it came about due to an automatic deduction from your bank. However, in other cases, it may have happened because it was believed that you went over your personal savings allowance (PSA). The amount you received was supposed to get you back to the original savings you were at. However, if it was believed you went over this amount then it was likely your pay-out was going to taxed.

Your pay-out will have included:

The only thing that can be taxed is your statutory interest. That’s why in order to make sure that you did not go over your PSA, the amount that was originally going to be paid out to you was deducted. This is where Gowing Law Solicitors can step in to help you get your money back through a PPI tax refund. By working with our experienced tax claim solicitors, you can get an experienced legal expert on your side and ready to get you your money back.

How much could I get from a PPI Tax refund?

You may be wondering why we have included a calculator in this blog. Well, if you do not want to immediately go to see a tax specialist, we want to give you the right tools to figure out an estimate of how much you could be owed from your PPI tax refund.

Let’s focus on the statutory interest that deducted your tax in the first place. It is very likely that your PPI Tax was actually deducted at a basic rate of around 20%. That means, for a £1000 refund, £200 was actually deducted in tax thanks to your statutory interest.

With that in mind, let’s use an example to help you understand how much you could be from your PPI tax pay-out. Peter is a mechanical engineer that earns around £19,000 per year. That means he pays a basic rate of around 20%. Gowing Law was able to help him get a PPI pay-out of £950, meanwhile his savings netted him around £150 in interest. That means he is around £100 over his allowance. He should, therefore, only be taxed on that £100 over the allowance, for the year, paying £20.

Due to the fact that Peter had a PPI refund payment was deducted at £190 at the source, that means he can now reclaim £170.

What about my own estimate?

Now that you have an example of how you can calculate a PPI tax refund pay-out, try to figure out your own pay-out by using the:

- PPI pay-out you received

- Your own basic wage

- How much tax you pay

If you need help figuring out how much you could earn from your claim, Gowing Law’s expert solicitors will make sure to give you advice on how your claim will be calculated. They can help you understand what you are owed and how you can claim it.

Will my tax bracket affect the amount of pay-out I receive from a PPI tax refund?

Yes! The amount of tax you pay will determine whether or not you could be eligible for a pay-out. Your pay-out is determined in relation to whether or not you went over your PSA and the wage from your job status. If you went over your PSA then it was very likely that you were going to have some of the pay-out deducted. Take a look at the tax brackets below. That way you can get a better idea of whether or not you could get a pay-out:

- Top Rate Payer (45%): Unfortunately, you will not be eligible for a PPI tax pay-out.

- High Rate Payer (40%): £500 tax free

- Basic Rate Payer (20%): £1,000 tax free

If you are feeling confused about whether or not your tax will affect your claim, make sure to speak to your solicitor about your concerns. It’s always best to be sure about whether or not you could be eligible for a claim. Having a solicitor on your side can make you feel secure when you try to get your pay-out. Your solicitor can ensure you get all the advice that you need. That way you can feel confident that you are going to get a valid pay-out. Feel free to leave the complicated paper-work to them so you can get the compensation that you deserve.

Can I make a PPI Tax refund claim if I wasn’t paying any tax during the year?

If you have received a pay-out for your PPI, you should be able to make a claim even if you have not paid tax over the last year. There is only one reason why you shouldn’t get your full pay-out. That is if your statutory payment ended pushing you over your PSA. If you are still feeling concerned about whether or not you could be eligible for a claim, Gowing Law’s specialists can ensure that you get the best advice possible to help you get the pay-out that you deserve. All you need to do is let our team know how we can help you.

How will a solicitor be able to help me with my PPI tax refund?

The best thing about having a legal specialist on your side is that if you can get advice about your PPI tax. We will always be there to help with your claim when you need it the most. We understand that tax claims can be extremely complicated. That’s why it’s useful to understand how you can make a valid claim without having to fill out any complicated forms. Our lawyers will make sure to do all the hard work for you, even if you have already been rejected for a claim. You may have made a very simple mistake that could have invalidated your claim. These are easy to sort out. Our lawyers can even speak to HMRC on your behalf.

Here are some additional reasons about why you should have a lawyer help you to sort out your PPI Tax claim:

- Expert advice when you need it the most

- Legal assistance to speak with HMRC on your behalf.

- Fill out any additional paperwork

- Avoid any simple mistakes that could invalidate your claim

- Quick communication to get your claim sorted

- Support when you need it the most during your claim

How long will it take to make a PPI Tax claim?

It will take you around 6-8 weeks to make a PPI Tax claim with Gowing Law Solicitors. However, please keep in mind that due to the current delays in the UK court system, it may take a tad longer. Your tax solicitor will do their best to keep you updated about your claim. They can tell you a timeline of claim to let you know how well it is progressing. They can also inform you of any challenges they may face and how they can be sorted. If you are concerned about the time it takes to get your pay-out, speak to a solicitor. They can give you peace of mind and let you know where your claim stands.

Speak to Gowing Law Solicitors today about your claim

Here at Gowing Law Solicitors, we are proud to be able to help people around the country. We are specialists with PPI Tax Claims. Our specialists will be able to help you and make sure that you get the pay-out that you deserve. You can come to us for no-obligation advice and consultations to get started. If you are happy to work with our solicitors, we can offer you our services on a “no win –no fee” basis. That means you will always be able to come out on top. There will be no hidden fees and you will only need to pay our lawyers if we win your case. So, what’s stopping you from getting in contact today?

Contact us to get started with your PPI tax claim today! Call us on 0800 041 8350, email info@gowinglaw.co.uk or use our claims checker. One of our tax specialists will then get in contact as quickly as possible to discuss your claim with you.

Learn more about PPI Tax claims

Don’t forget that Gowing Law’s blog is updated with new content every week. This includes information about tax claims, personal injury claims, insurance claims and much, much more! If you have a suggestion for our blog, feel free to share it with us by emailing info@gowinglaw.co.uk. One of our helpful team members will be in contact about when we will write about your ideas. We also update our blog with information about different seasonal events and holiday topics.

You should also keep an eye on our social media feeds to see our most updated videos and latest giveaways. We tend to celebrate holidays with new competitions and informative campaigns. So, make sure to follow both our Twitter and Facebook. You can find links to both our pages at the bottom of this blog.

We wish you the best of luck with your claim and look forward to seeing you in our next blog!

Recent Comments