Personal injury claims are the best way to get a compensation pay-out if you have been hurt due to someone else’s negligence. No one goes out expecting to get hurt. Whether you were hurt in a work accident or you were hurt in a public place (like a store), you have suffered from injuries that were not your fault. That means you are entitled to compensation in order to help you recover from your damages. However, with the current lockdown in place, your worries may not actually be about your injuries. Instead, you may be worried that you are asked to go in to court if a settlement agreement cannot be reached.

If you are worried about the prospect of catching Covid-19 by leaving your home for court, we understand that you may be considering stopping your claim and starting it again at a later date. However, we would advise against this. The longer you leave your claim, the less likely that it will be valid in the future. You may also lose vital evidence that could impact the amount of pay-out you receive from any sort of settlement agreement.

Here at Gowing Law Solicitors, we will be here to support you throughout any claim you have. Whether that is a tax claim or personal injury claim, our specialists will give you tailored advice that can ensure you feel good about how your claim is being handled. Our lawyers will give you advice on how to adhere to social-distancing regulations whilst your claim is sorted. That way you can get your pay-out in a reasonable time. Learn more about starting your claim with the help of our claims checker:

What is happening within the UK court system right now?

As the UK has entered its third lockdown, it is crucial that everyone adheres to remaining at home. The only reason that you should be travelling is for essential reasons. Unfortunately, this means that there is going to be an impact on the lives of people all over the UK. For those who have experienced a personal injury and are undertaking a claim, it may make it more complicated for collecting evidence or setting up meetings with other people involved in the accident. This has only been made worse with the delay in the UK court system.

Recently the UK court system has been dealing with a backlog of cases. As the courts closed during the first lockdown, this meant that compensation claims were pushed back in order to accommodate the new social-distancing laws. This has meant that it has caused problems in the future. Due to the backlog, the courts struggled to find time to make sure that clients could be rescheduled without it impacting other court cases. This is what may have happened to you during the lockdown. If you are a victim of the backlog, it may be wise to get a solicitor on your side to help you get back in control of the case. They can assist you with the organization of your case and make sure any deadlines are adhered to. They can also let you know the most current updates about how your personal injury claim is progressing.

What should I do if I have suffered from a personal injury?

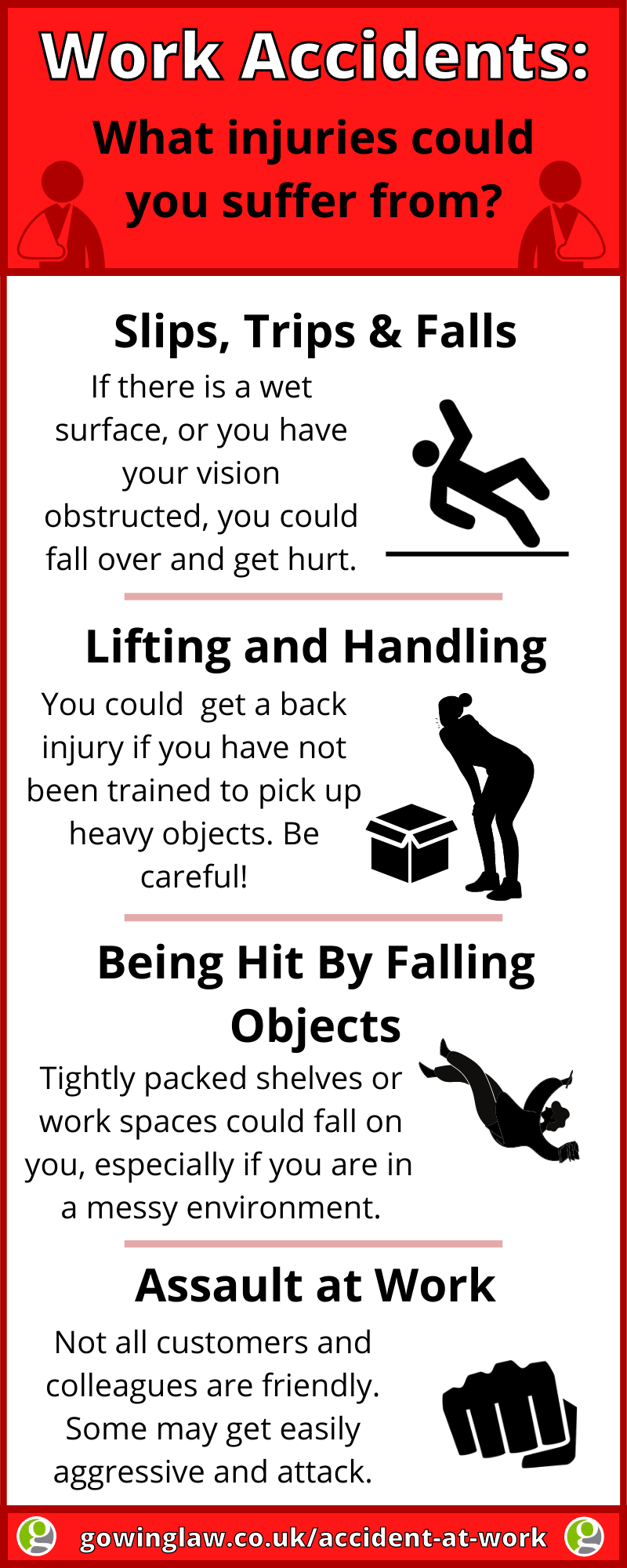

If you have recently got hurt in an accident that was not your fault, you could be eligible to make a claim with the help of a personal injury claims solicitor. Whether it was at work or you got hurt in a public space, the negligence of someone else has caused you substantial injuries that could change your life for the worst. In a public space, the owner or staff owe you a “duty of care”. That means they have to do everything possible in order to keep you safe. Unfortunately, you could still get hurt if:

- They have not been trained

- You were in a messy area prone to accidents (i.e. falling boxes or merchandise)

- There were slippery areas that were not marked

- You were forced to interact with violent staff/customers

Now, the amount you get from any sort of personal injury claims depends on the extent of your injuries. For instance, if you ended up hurting your legs and found out that you would need a wheel chair to move around for the long-term future, this would end up getting you a higher pay-out than if you suffered from a few cuts and bruises. The extent of a pay-out from personal injury claims depends on the damages you have suffered and the evidence you have. Your physical damages are one thing, but you can also suffer from emotional damages, financial damages, equipment damages and loss of opportunity. You will need evidence to prove you have been hurt. Check out the infographic below to see what type of evidence could back up your claim:

Personal Injury Claims: How do I get the best pay-out possible?

Having talked about how you could be eligible when making personal injury claims, it’s now important that you understand the best way to make a strong claim in general. When you get hurt due to someone else’s negligence, you suffer from damages. To be eligible for a claim, you must have experienced physical damages in the form of an injury. But you could have also suffered from:

- Emotional Damages

- Financial Damages

- Equipment Damages

- Loss of Opportunity

If you have experienced any sort of damages or are hurt in an accident, the first thing you should do is alert the staff of the public space. They can give you help, call an ambulance and also note down your personal injury in their work accident book. The most essential thing you need is medical attention. Having a doctor check you over can prove that you were hurt due the negligence of someone else. It can also ensure that you don’t suffer any further damages. If you are well enough, don’t forget to collect evidence. But remember, your health is the main priority when it comes to your claim.

If you follow these instructions, you should be able to help your solicitor create a strong claim before you decide on your settlement agreement. They will be there to support you through any sort of personal injury claims.

What can I do to collect personal injury claims evidence during lockdown?

Right now, you may be thinking about how you can continue with a claim throughout lockdown. You are not supposed to be going anywhere outside of your home unless it is for essential travel. That’s why you may feel concerned that this could affect your claim. For instance, you may be struggling to get a medical report in decent time. You may also be struggling to find evidence in general due being unable to leave your home.

We would advise that you do as much as you can without putting yourself in danger. Evidence for your claim can appear before, during and after the incident. Collect what can be collected without breaking any rules. For instance, if you want a medical report, be prepared for delays depending on the availability of your doctor. You may need to focus on damages that are affecting you in the present, such as financial damages or images of your injuries. If you have witnesses, make sure to have their contact details so you can electronically contact them about making a witness statement. The best way to do this is through e-mail so they can be clear about what happened during the accident.

Will I need to go to court during the lockdown if I make a personal injury claim?

As the UK is currently experiencing a backlog in court cases, you may find that it is not necessary for you to go to court to get your claim sorted. In most cases, you will not need to go to court to get your compensation negotiated. Instead, you, your solicitor, the other party and their insurer can sit down and talk about compensation through a settlement agreement. This means everything can be sorted internally and you will not need to put yourself at risk.

If you do need to go to court, your lawyer will help you make sure that everything is scheduled appropriately. It is likely that instead of going into a physical building, you will be asked to attend an electronic/remote hearing. You can prepare for a remote hearing by:

- Making sure you have a laptop that has a video and audio connection

- Ensuring you have strong Wi-Fi that can connect you to the internet

- Checking whether or not you can bring support into the hearing

- Making sure you are able to sit comfortably in a quiet area to you can hear everything that goes on during the hearing

You should also try to speak clearly so the judge can understand you. If you cannot understand the people on the call, due to bad Wi-Fi, make sure to alert the judge to this. Your solicitor can give you more advice to prepare for any sort of remote court case in the future.

How long will it take to make personal injury claims during lockdown?

As we are currently in the middle of a pandemic and lockdown, you will find that it will take longer to make any sort of claim. This is due to the backlog of court cases. So, keep in mind that the longer you leave your claim, the more likely it is that it will take longer to get a pay-out. A lot of the cases that have been pushed back are now taking priority. That’s why we think it is essential that you speak with a lawyer as quickly as possible. That way they can start scheduling your claim and making sure that you get the pay-out that you deserve.

We would just like to state that the schedule of any sort of personal injury claims depend on the complexity of the case. For instance, if the other party does not accept responsibility for your accident, you will find that the claim will take longer than anticipated. That is because you need to speak to your solicitor about scheduling meetings, collecting evidence and getting a court date booked. Keep this in mind when you talk to your solicitor about your claim. They will be very grateful for your patience. Feel free to keep checking in and asking for updates about the claim. They would be happy to give as much information to you as possible.

Will I be able to still get a pay-out during the lockdown?

Personal injury claims are the best way to get the compensation that you deserve for any accidents that were not your fault. If you have a successful claim, the amount you get will depend on the extent of your injuries and damages. Even if you cannot go into court physically, you will still get the pay-out you deserve. Your solicitor will make sure that you receive your cheque as soon as possible. But keep in mind with the delays to Royal Mail, it may take a little longer than anticipated. So, remain patient and feel free to ask for updates as many times as you like.

Gowing Law Solicitors is here to help you with your personal injury claims

Here at Gowing Law Solicitors, we are proud that we can still help our clients throughout lockdown. We understand that you may feel intimidated by the idea of making a personal injury claim during lockdown. But our solicitors and law firm will be here to support you throughout the claim. We can offer you no-obligation advice and consultations to get started. If you are happy to work with us, we can offer our help on a “no win-no fee” basis. That means you will not need to pay any hidden fees and will always come out on top. You will only need to pay our solicitors if we win your case.

If you are ready to get started with our lawyers, contact us today to learn more about your claim. Call us today at 0800 041 8350, email info@gowinglaw.co.uk or use our LiveChat to quickly speak to one of our legal experts. We will do our best to answer any questions that you may have about your future claim.

Read more about Personal Injury Claims!

Gowing Law’s blog is updated every week with brand new content about UK legal claims. So make sure to keep an eye on it to see our latest content and videos. You will also learn about seasonal updates and Gowing Law’s latest competitions. We love hosting giveaways for our clients. So, make sure to keep an eye on our socials to see what our next plans are! If you cannot find a blog that answers your questions, feel free to write in with your suggestions to info@gowinglaw.co.uk.

We look forward to seeing you in our next blog!

Recent Comments